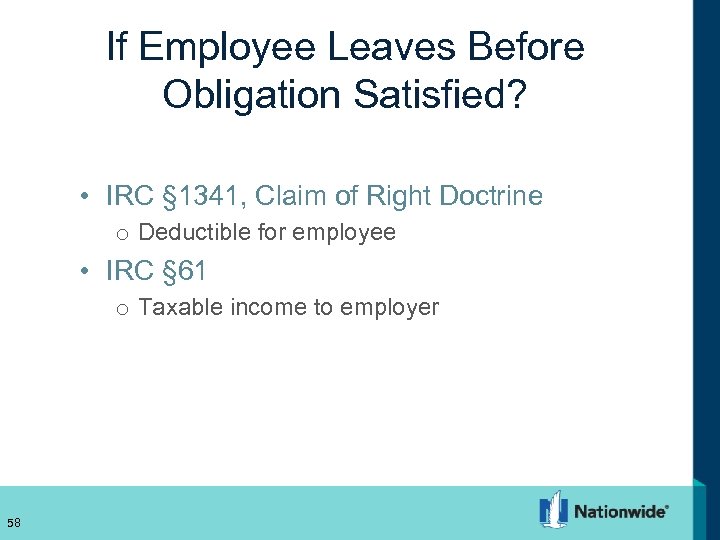

We want to express our deep appreciation to our Temple colleagues Jane Baron and Andrea Monroe who provided pointed and helpful comments as Discussants at the Temple Faculty Colloquium at which we presented an earlier version of this Essay, as well as to those colleagues who participated in the Colloquium. Professor of Law, Temple University’s Beasley School of Law. Gross income defined on Westlaw FindLaw Codes are provided courtesy of Thomson Reuters Westlaw, the industry-leading online legal research system. Section 61 states that 'except as otherwise provided in this subtitle, gross income means all income from whatever source derivedInternal Revenue Code 61. 61) defines 'gross income,' the starting point for determining which items of income are taxable for federal income tax purposes in the United States. Section 61 of the Internal Revenue Code (IRC 61, 26 U.S.C.

All errors, omissions, and deficiencies remain ours.Section 61 of Evidence Act 'Proof of contents of documents' The contents of documents may be proved either by primary or by secondary evidence. Finally, we gratefully acknowledge the financial support of our research provided by Temple University’s Beasley School of Law. Ashley Rivera, Temple ’13 (J.D.) and ’14 (LL.M, Taxation) once again provided exemplary research assistance. We are especially indebted to Professor Larry Zelenak, whose critique of our earlier work has helped us to refine and expand our analysis and who has been gracious in his public engagement with our ideas.

And he concludes by proposing “legislation aimed at retaining the practical advantages of customary deviations while assuaging rule-of-law concerns.”. He worries that “the lack of any judicial check on unauthorized giveaways by tax administrators threatens rule-of-law values,”. 829 (2012) (evaluating administratively created customary deviations from the Internal Revenue Code). Zelenak, Custom and the Rule of Law in the Administration of the Income Tax, 62 Duke L.J. Administrative Code 61:I.1140 and Revenue Information Bulletin 09-009 have been published providing guidance whereby these organi- zations are not.In a recent essay on what he identifies as “customary deviations” from the dictates of the Internal Revenue Code, Professor Larry Zelenak asserts that the Internal Revenue Service has regularly created administrative deviations from the Code that produce taxpayer-favorable results that cannot be challenged in the courts because taxpayers lack standing to bring such challenges. Explanation 1 Where a document is executed in several parts, each part.

101 (2012) (suggesting that standards are superior to rules in interpreting the definition of income). Greenstein, It’s Not a Rule: A Better Way to Understand the Definition of Income, 13 Fla. 295 (2011) (suggesting that the IRS considers both economic and noneconomic values when applying the definition of income) Alice G. Greenstein, Defining Income, 11 Fla.

Permitting the evolution of a concept of income that serves. As he explains:According to Professors Abreu and Greenstein, the statutory definition of gross income (as glossed by Glenshaw Glass) “gives the IRS the flexibility to navigate the shoals of social opinion regarding income taxation, thereby. Zelenak, supra note 1, at 836–37.

In fact, the IRS’s most significant pronouncement on the topic—its 2002 announcement—implies the opposite when it states that “the IRS has not pursued a tax enforcement program” with respect to frequent-flier miles and notes that “ny future guidance on the taxability of these benefits will be applied prospectively.” Thus, far from claiming that its position is an interpretation of the statute, the IRS acknowledges that it is not enforcing the law.Id. Professor Zelenak goes on to observe:Moreover, the IRS has never stated that frequent-flier miles are not within the scope of § 61. (citing Abreu & Greenstein, Defining Income, supra note 4, at 300) (alterations in original). Nothing in the language or legislative history of § 61, and nothing in Glenshaw Glass, suggests (for example) that employee-retained frequent-flier miles are not within the definition of gross income.

Alternatively, the IRS may be saying that it is not sure what the law is and is foregoing enforcement pending clarification of the law’s meaning. Perhaps, as Professor Zelenak believes, the agency is “acknowledg that it is not enforcing the law.” Id. But the most that can be said about these IRS pronouncements is that they are ambiguous.

We offer a different analysis. It seems that, for him, the Code provides rules that are to be strictly interpreted, so IRS positions that are inconsistent with that strict interpretation are deviations. Professor Zelenak finds that path in what he refers to as “the Code as written.”. A deviation requires identifying a clear path (or rule) from which the deviation occurs.

Abreu & Greenstein, Defining Income, supra note 4, at 346. We asserted in Defining Income that both the IRS and the courts have treated the definition of income as a standard rather than a rule, and that acknowledging the provision to be a standard clarifies its non-linear construction. See infra note 31 and accompanying text.

Professor Zelenak’s concern is thatO anyone who takes the rule of law seriously, it is troubling to contemplate that the Treasury and the IRS are almost unconstrained in their ability to make de facto revisions to the Internal Revenue Code enacted by Congress, as long as those revisions are in a taxpayer-favorable direction. Many are rules—but not the definition of income.Professor Zelenak’s essay makes an important contribution by clearly identifying a central concern regarding the IRS’s treatment of income: respect for the rule of law. We do not claim that all provisions of the Code are standards. In short, where Professor Zelenak sees a deviation that threatens rule-of-law values, we see a non-exceptional, fully lawful interpretation of a standard. If there is no rule that all accessions are income, there is no need to find an exception or posit a deviation in order to conclude that a particular accession is not income.

Irc 61 Free Or Low

For Professor Zelenak, respect for the rule of law entails an obligation of the Treasury and the IRS not to “disregard Code,”. Anti-taxpayer positions will be challenged when the amounts are large enough and the taxpayers are wealthy enough or have sufficient access to free or low-cost representation to bring a challenge, but too often the Service’s assertion of an anti-taxpayer position produces a compromise or capitulation by the taxpayer because of the cost of mounting a challenge.Addressing this concern directly allows us to refine our analysis of the role of rules and standards in federal income tax law. We agree that anti-taxpayer positions are much more likely to be challenged—and indeed nearly all tax litigation consists of such challenges—but we do not think that anti-taxpayer positions are fundamentally different from pro-taxpayer positions for that reason alone. Professor Zelenak limits his definition of customary deviations to taxpayer-favorable interpretations and worries about their potential corrosive effect on rule of law values because a pro-taxpayer interpretation is effectively immune from challenge, given that taxpayers directly affected would have no interest in challenging it and others would lack standing to do so. Zelenak, supra note 1, at 851.

0 kommentar(er)

0 kommentar(er)